Menu

Return on investment (ROI) is a ratio that measures how efficient a particular investment is. It is the mandatory starting and ending point for any ambitious investor because it presents the potential of a future deal as well as the end results of a completed one in simple numbers.

ROI is calculated by dividing the profit from an investment by the initial investment amount. This metric is typically expressed in percentages because it facilitates comparing different investment plans – you can see at a glance which will benefit your account and which will be a loss, especially with our ROI calculator.

Let’s break down the ROI formula:

ROI = (net profit / total investment) x 100.

The net profit is calculated as the difference between the net benefit and the net cost of making the investment. The total investment is the amount of money that has been decided to put into a specific venture. We multiply the ratio by 100 to get the result as a percentage. Our return on investment calculator employs the above formula.

ROI is a popular metric because it is simple to calculate and provides definite answers to the situation and figures at hand. It’s also a very popular term, so if you mention it or ask someone to do it for you, they’ll most likely know what you’re talking about.

This efficiency ratio can be applied to any and all profitability measurement situations. It is widely used in finance, marketing, investing, and business operations, among other things.

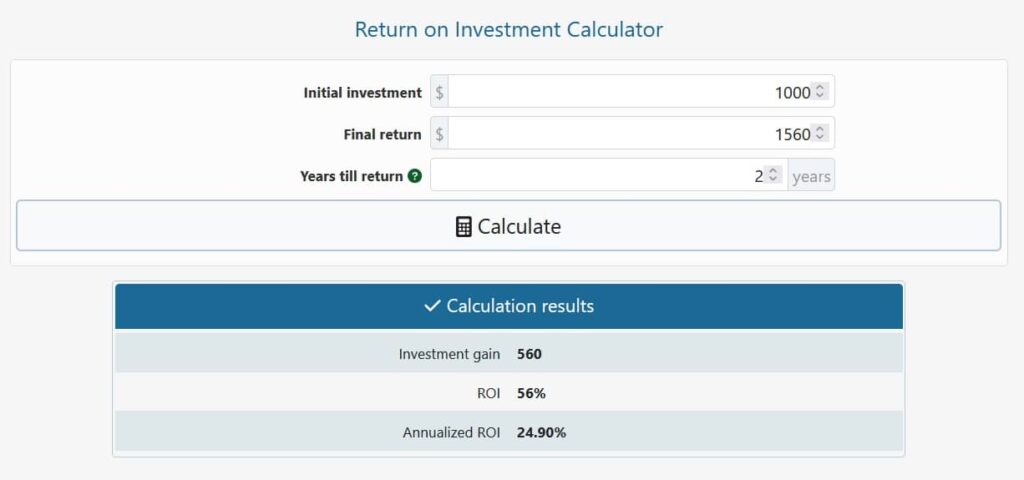

The return on investment calculator allows you to assess the price of each dollar you invested. All you would like to try to to is input the quantity of your initial investment and therefore the final return, and mark the period of time across which the investment spans.

At the press of a button you’ll receive valuable information regarding your investment gain, your ROI and therefore the annualized return – both in percentages.

You can use this tool to research your ongoing investments or compare prospects you’re considering and choose which you ought to choose .

Low-performing and high-performing investments are going to be easily differentiated. Some could also be of negative value, whereas others are going to be positive. In other cases, maybe all of the investments are going to be profitable, however – some more beneficial to you than others.

Having this information in mind, you’ll optimize your strategy, business plan or portfolio with our handy ROI calculator at your side.

Despite its flexibility, there’s an excellent limitation associated with return on investment: It doesn’t take into consideration time as an important factor. When comparing two ventures, one must confirm they’re spread across an equivalent period of time so as to receive truthful numbers. Otherwise, it’s going to seem that they both have an expected ROI of 35% for instance , within the first case it being achieved in one year, whereas the second needs four years to be completed.

Evidently, a 35% ROI over a year is much better than over 4 years. So, so as to beat this setback, you’ll calculate and analyze the annualized return on investment (supported by our calculator). The formula utilized in this case is:

Annualized ROI = [(ending value / beginning value) ^ (1 / number of years)] – 1,

where the number of years equals (ending date – starting date) / 365.

For example, imagine you buy stock in a tech company worth $1,000 on January 1, 2012. You then decide to sell it on January 1, 2015 for $3,200. Your annualized return will be as follows:

Annualized ROI = [(3,200 / 1,000) ^ (1/3)] – 1 = [(3.2 ^ (1/3)] – 1 = 1.47 – 1 = 0.47 = 47%.

In contrast, if you calculate the regular return on investment, the figures will be misleading:

Regular ROI = (3,200 – 1,000) / 1,000 = 2,200 / 1,000 = 2.2 = 220%.

Of course, the easiest way is to just plug the numbers into the ROI calculator above.

© 2021 All rights reserved

Ask Your Query