Menu

An annuity is a financial institution-issued and distributed insurance contract that promises to pay out invested cash in a set income stream in the future. Annuities are purchased or invested in using monthly premiums or lump-sum payments. The holding institution creates a future stream of payments for a set amount of time or for the rest of the annuitant’s life. Annuities are mostly utilised for retirement planning and to mitigate the danger of outliving one’s resources.

Annuities can be built based on a variety of characteristics and factors, such as the length of time for which annuity payments are guaranteed to continue. As previously stated, annuities can be designed to pay out for as long as the annuitant or their spouse (if a survivorship benefit is chosen) is alive. Annuities can also be set up to pay out funds for a set period of time, such as 20 years, regardless of how long the annuitant lives.

Immediate and Deferred Annuities

Annuities can start right away if a lump payment is deposited, or they can be arranged as delayed benefits. After the annuitant deposits a lump sum, the immediate payment annuity begins paying immediately. Deferred income annuities, on the other hand, do not pay out until after the original investment has been made. Instead, the client chooses an age when they want to start receiving payments from the insurance provider.

Fixed and Variable Annuities

Variable annuities allow the owner to receive larger future payments if the annuity fund’s investments perform well and smaller payments if the fund’s investments perform poorly, resulting in less stable cash flow than a fixed annuity but allowing the annuitant to benefit from the fund’s strong returns.

While variable annuities are subject to market risk and the possibility of losing money, riders and features can be added to annuity contracts for an additional fee. As a result, they can be used as hybrid fixed-variable annuities. Contract owners can benefit from the portfolio’s upside potential while also being protected by a lifetime minimum withdrawal benefit if the portfolio’s value dips.

Other riders can be added to the agreement to include a death benefit or accelerate payouts if the annuity holder is diagnosed with a terminal disease. Another popular rider that adjusts annual base payment flows for inflation depending on changes in the consumer price index is the cost of living rider (CPI).

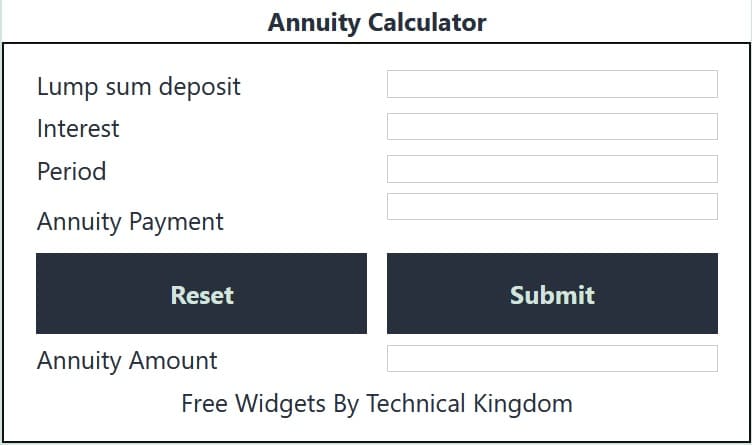

The current value of annuities is determined by discounting future cash flows and calculating the present value of the cash flows. The following is a general formula for calculating the value of an annuity:

Formula for calculating annuity values

Where:

PV denotes the annuity’s current value.

P = Payment in advance

n = Total number of annuity payment periods r = Interest rate

Perpetuity value differs from other valuations in that it does not incorporate a set end date. As a result, the value of the perpetuity is calculated using the formula:

PV = P / r

© 2021 All rights reserved

Ask Your Query