Menu

Our online Net Present Value calculator is a useful tool for calculating:

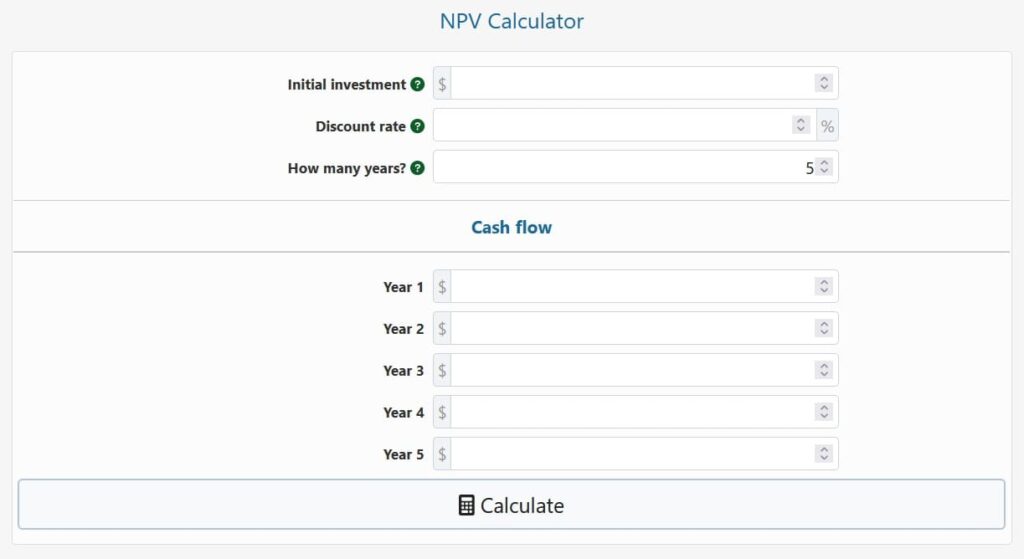

Begin by inputting the initial investment and the investment period, then the discount rate, which is often the weighted average cost of capital (WACC) after taxes, but some people prefer to use larger discount rates to account for risk, opportunity cost, and other considerations. It is entirely up to you to make this decision. Finally, for each year or other period, insert the net cash flow (a maximum of 25 periods are allowed). Make sure you enter the free cash flow rather than the cash flow after interest, as this will result in the time value of money being double-counted.

The Net Present Value, IRR, gross return, and net cash flow for the full term will be calculated using our NPV calculator.

The net present value (NPV), also known as net present worth (NPW), is defined as the present value of a projected income stream compared to its prospective value in the future, which is discounted at a set rate. It’s just the difference between the present values of cash outflows (including beginning costs) and the present values of cash flows over time, discounted at a rate that reflects the time value of money. The net present value is defined as the sum (Σ) of the present value of the predicted cash flows (positive or negative) minus the initial investment, according to the textbook.

Consider a $500,000 business investment that is expected to generate $50,000 in cash flow in a year or a 10% return on capital. If the cost of capital is 11% per year, the present value of the $50,000 income stream is negative (-$4,504.50 to be exact), indicating that the investment is not justified. However, if the cost of capital can be cut to 5%, the current net worth of this same cash flow will be 23,810 USD, indicating a more efficient use of capital and making the business venture worthwhile.

To calculate the present value, we must first determine a discount rate. As it relates to how the firm funds its activities, it is fundamentally company-specific. In the case of borrowed capital, using WACC is good; but, if it is calculated from the perspective of investors and shareholders, it can be chosen to reflect the rate of return they expect. When computing NPV for a business, for example, if shareholders expect a 10% return, this is the discount rate to utilise.

All you need is the formula to calculate the Net Present Value (NPV) on your own or using an Excel spreadsheet:

C0 is the initial investment, and Ct is the return during period t, where r is the discount rate and t is the number of cash flow periods. For example, with a ten-year term, a $1,000,000 initial investment, and an 8% discount rate (average return from a risky investment), t is 10, C0 is $1,000,000, and r is 0.08.

Let’s look at an example of how to apply the Net Present Value calculation to determine the profitability of a home purchase. Let’s pretend the house costs $500,000 and is expected to sell for $700,000 in three years. The annual cost of maintenance and taxes is $10,000. At the same time, a T-Bond, with a yield of 5% per year, is a less riskier investment, and this will be our discount rate. When we plug the data into the Net Present Value calculator, we get an NPV of $77,454, which isn’t terrible considering the additional risk. We may also examine the IRR, which is 10%, which is twice as high as the T-Bond yield of 5%. However, if the risk is more than twice as high as the safer option, the investment may not be prudent.

In the preceding formula, only the initial investment is an accurate number. All of the other numbers are estimates and projections. If they are off by a certain amount, for example, if the final sale price is only $650,000 and the maintenance costs are twice as much, the investment may provide a discounted return of close to zero.

© 2021 All rights reserved

Ask Your Query