Menu

To use the calculator, simply enter the car’s purchase price and its age when you bought it (0 for brand new, 1 for 1-year old, etc.). The car depreciation calculator will calculate the depreciation for the following 8 years if the “Depreciation period” field is left blank. Enter “5” in this section if you know when you want to sell your automobile, for example 5 years after purchase, and you’ll see the worth of the vehicle after 5 years, the % depreciation, the absolute cash loss, and the average loss each year.

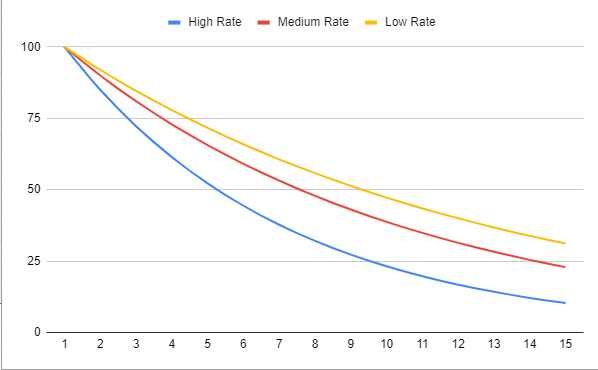

You have the option of selecting a depreciation rate for the car: low, medium, or high. The chart below presents a comparison of the three curves:

As can be seen, most cars lose the greatest value in the first year after purchase, then lose less value until they are roughly 10-years old, at which point the rate of value loss slows even more. The figures in the calculator are based on industry averages and should only be used as a guide. Your car’s real depreciation will vary depending on its level of maintenance, kilometres driven, market conditions, and the price of relevant fuel, among other factors. A car’s value may deteriorate at various rates in different markets, for example, in the United States, where average mileage is higher, than in the United Kingdom, where it is normally lower.

Depreciation is the decrease in the worth of a car when you contemplate it in the future, such as when you intend or expect to replace it with a newer vehicle. A car’s value begins to depreciate the moment it is purchased by a buyer, often by 10%. Its value plummets dramatically during the first year of exploitation, plummeting by 15-30% on average. From then on, it declines at a slower rate each year as newer, better cars hit the market and the vehicle’s mileage and wear and tear grow. Around 9-10 years in, depreciation begins to slow.

While depreciation is influenced by variables that the owner may control, such as proper maintenance, minimal usage on good roads, and so on, it also loses value as a result of external factors such as market changes, customer demand shifts, and increased regulatory requirements, to name a few. As a result, it’s a good idea to think about whether you want to buy a brand new car that will depreciate quickly in the first few years or a used car that would depreciate more slowly. Depreciation is only relevant if you want to sell the car and replace it. It is less of a concern if you intend to keep your vehicle for a long time.

Assume you’re in the market for a car and must choose between a brand new automobile and a used 4-year-old car, with the expectation that the car will be replaced after 5-6 years in both circumstances. Naturally, all potential expenditures like maintenance, insurance, and so on must be considered, as well as perks such as increased safety, fuel efficiency, and so on for the newer model. However, even after accounting for these factors, the issue of automotive depreciation persists, and it is a fact that an automobile’s manufacturing year is often the key determinant of its sale price.

If a new automobile of our chosen brand and model costs $56,000 and a four-year-old used one costs $38,000, the graph above can be used to establish that the model’s rate of depreciation is on the low end (32 %decrease in 4 years). With that information, you could make a table like this to compare the costs of new and used cars depending on the total annual cost:

Depreciation, maintenance, and total cost per year are all averages; in actuality, maintenance rises each year while depreciation falls. This automobile depreciation calculator was used to compute annual depreciation, which is only an estimate for any real-world situation.

Assuming that the maintenance costs cover all costs associated with keeping the automobile in excellent working order and paying all required insurance, the overall annual cost figures suggest that the luxury of owning a brand new car will cost $1,500 more per year on average than the second-hand choice. The increased rate of selling value depreciation accounts for $1,000 of those.Furthermore, you will be required to make a bigger first payment.

Which alternative to choose is obviously determined by one’s financial situation and circumstances, but knowing the cost of that decision should help one make a more educated decision.

© 2021 All rights reserved

Ask Your Query