Menu

The term yield-to-maturity, or YTM, is intimately associated with bonds. As a result, YTM is an important concept for debt mutual funds. The annual return is expressed as YTM. It shows us what the total return on a bond will be if the investor holds it to maturity. A debt fund’s underlying assets are a variety of government and corporate bonds that the fund manager selects to keep in the portfolio.

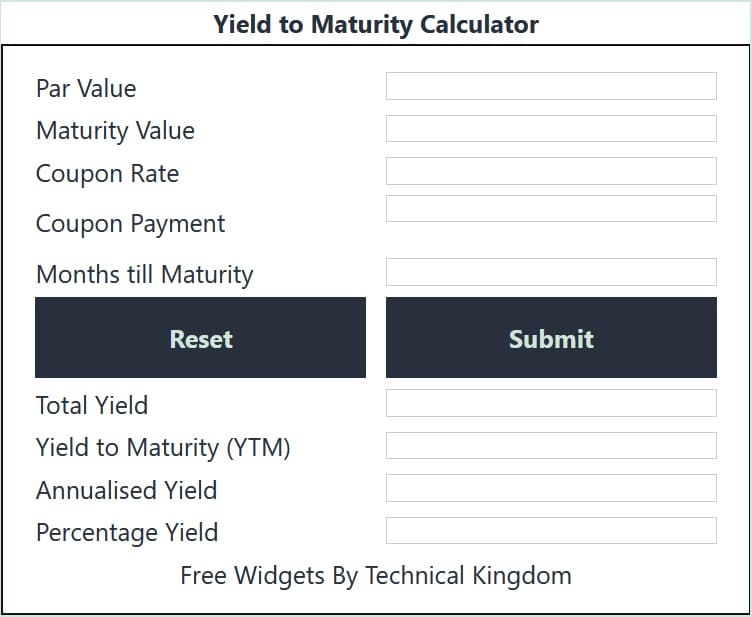

The formula to calculate YTM is:

Assume that XYZ Ltd. issues Rs 2,000 yearly bonds with an interest rate of 8%.

Here

8% interest rate on coupons

Payment frequency is once a year (Annual)

Rs 2,000 face value

The issue date is August 17, 2020.

Five years of maturity

When you acquire a bond when it is first issued, you will be paying face value for it, which will also be your purchase price. On August 17, 2021, the bonds will pay coupons at an interest rate of 8%, or Rs 160.

When a bond sells for less than its face value, it signifies that the going interest rate is higher than the coupon rate. In this case, YTM will be higher than the coupon rate of 8%. If the bond is selling for more than its face value, this indicates that the market interest rate is lower than the coupon rate. The YTM is less than the coupon rate, indicating that the YTM is less than the coupon rate.

© 2021 All rights reserved

Ask Your Query