Menu

Our free Discounted Cash Flow calculator assists you in determining the Discounted Present Value (also known as intrinsic value) of future cash flows for a business, stock investment, or home purchase, among other things. When future conditions are uncertain and there are distinct periods of high development followed by gradual and steady terminal growth, discounted cash flow is more appropriate.

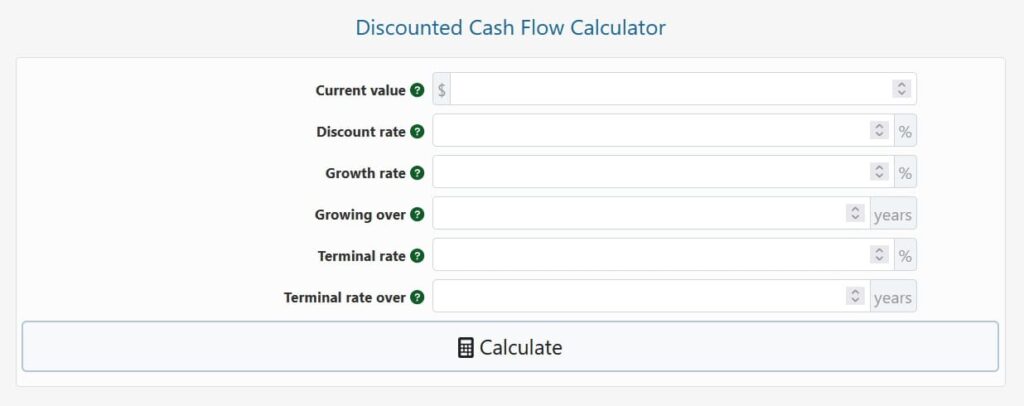

Begin by inputting the initial investment, price per share, purchase price, and so on. Next, enter the discount rate, which is typically the weighted average cost of capital (WACC) for a company valuation, or the “risk-free rate” for other forms of investments, such as T-bond return. Enter the estimated average growth rate and the time period during which the investment is expected to increase. Finally, enter the terminal rate as well as the time period during which you expect your investment to grow at much lower rates.

The following are the results of our DCF calculator: Growth Discounted Present Value (also known as growth intrinsic value), Terminal Discounted Present Value (also known as terminal intrinsic value), and the sum of the two values, Total Discounted Present Value (a.k.a. total intrinsic value).

It is a method for calculating a project’s, company’s, or asset’s business valuation based on the time value of money idea, in which future cash flows are discounted using the cost of capital to arrive at a discounted present value (DPV). Its purpose is to calculate the value an investor would receive if the risk-free rate of a different accessible investment was used. If the present value estimate is higher than the investment’s current cost, the project is worth investigating.

.Consider this easy example: $100 deposited into a savings account now will be worth $105 a year from now (5 percent interest anticipated), but if the $100 is not put into the savings account for a year, it will only be worth $95 because it cannot be put into the savings account.

DCF is used in investment finance, real estate development, corporate financial management, and patent valuation in court cases when one can control and forecast with fair precision. Garbage in equals garbage out, as with any other approach. The fact that variable discount rates and changing cost of capital are not supported in their naïve form is one of its drawbacks.

Another flaw is that the cyclical nature of markets isn’t taken into consideration, therefore the average return during both the growth and terminal stages can be erroneous due to major market changes.

Example application: An investor is considering investing $1 million in a company in exchange for a 5% stake (current company valuation is $10 million => current value of the 5% stake is $500,000), and he expects it to grow at a rate of 15% per year for the next three years, then slow to about 5% per year for the next five years. Is it worthwhile to invest when the market average return during this time period is predicted to be 11%? We can see that the overall DPV is almost $4 million after plugging in the numbers, thus the $3 million difference is a good compensation for taking the risk of investing in a single company. However, the difference is only $600,000 for the first three years, implying that if a quick exit is desired, he should be prepared to accept a lower salary.

If you want to compute the Discounted Present Value (DPV) on your own or with an Excel spreadsheet, all you need are the discounted cash flow (DCF), future value (FV), and DPV formulas:

CFo-n represents the cash flow for each period, whereas t is the specific time in the third formula, where r is the discount rate and n is the number of cash flow periods. In summation formulas, Σ is the well-known sigma symbol.

© 2021 All rights reserved

Ask Your Query