Menu

A bond is a debt product that is offered to investors and is usually issued by the government or a firm. By purchasing the bond, investors are lending money to the bond issuer. Investors will get returns in the form of coupons throughout the bond’s life and the face value when it matures.

The present value of the cash flow created by the bond, namely the coupon payment during the bond’s life and the principal payment, or the balloon payment, at the end of the bond’s life, is used to calculate the bond price. The bond price chart in our calculator shows how it varies over time.

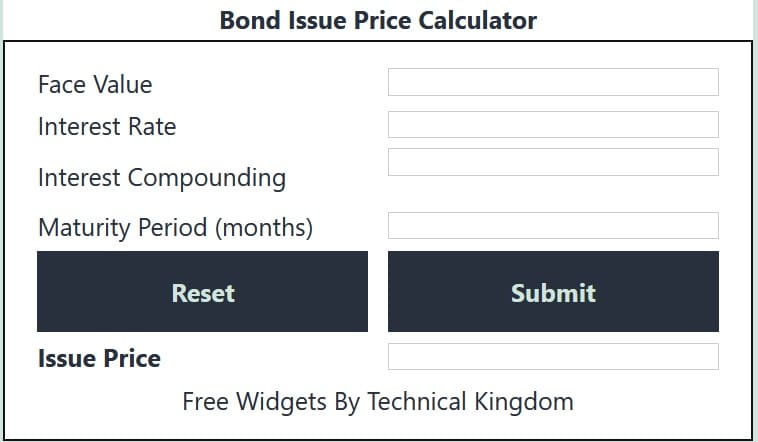

You must enter the following information into our current bond price calculator to use the bond price equation:

Example

Let’s take Bond A issued by Company Alpha as an example. It has the following data:

The instructions for using the bond valuation calculator are as follows:

You’ll need two inputs to calculate the coupon per period: the coupon rate and the frequency.

The following formula can be used to compute it:

face value * coupon rate / frequency = coupon per period

The frequency is 1 because this is an annual bond. Bond A has a coupon of ($1,000 * 5%) / 1 = $50.

The n is the number of years between now and when the bond matures. Bond A has a n of ten years.

The annual rate of return that a bond investor will receive if they retain the bond from now until it expires is known as the YTM. YTM is equal to 8% in this case.

As previously stated, the bond price is the net present value of the bond’s cash flow, which can be computed using the following bond price equation:

bond price = Σk=1n[cf / (1 + r)k],

where cf stands for cash flows, r stands for year to maturity, and n stands for years to maturity.

As a result, Bond A’s price will be $50 / (1 + 8%).

(1 + 8% ) = 1 + $50

1 + 8% = 2 + $50

/ (1 + 8% ) 3 +… + $50

1 + 8% = 9 + $1,050

10

Ultimately, the bond price equals $798.70.

You may track the present values of payments on the bond price chart for a specific period using our bond price calculator.

Coupon: A bond’s interest payment is called a coupon. Depending on the bond, it is usually distributed annually or semi-annually. It’s usually computed by multiplying the coupon rate by the bond’s face value.

YTM: The yield to maturity of a bond is referred to as YTM. It is the rate of return that bond investors will receive if they hold a bond until it matures.

Face value: The face value of a bond is often referred to as the principal. If the bond issuer does not default, it is the amount of money the bond investor will get at maturity. If a bond is held to maturity, this is the last payment an investor will receive.

© 2021 All rights reserved

Ask Your Query