Menu

The Equated Monthly Installment, or EMI, is the monthly payment made to the bank or other financial institution until the debt is completely paid off. It includes both loan interest and a portion of the principal amount to be returned. The total of the principal and interest is divided by the loan’s term, or the number of months it must be repaid in. This amount must be paid on a monthly basis. The EMI’s interest component would be higher at the beginning and subsequently decrease with each payment. The exact percentage allocated to principal payment is determined by the interest rate.

Here’s the formula to calculate EMI:

where E stands for EMI

P stands for Principal Loan Amount

The monthly interest rate is denoted by the letter r. (i.e., r = Annual Interest Rate/12/100.) If the annual interest rate is 10.5 percent, then r = 10.5/12/100=0.00875).

n denotes the loan term, tenure, or duration in months.

For example

If you borrow $10,000 from a bank at a rate of 10.5 percent per year for ten years (120 months), your EMI will be: $10,000 * 0.00875 * (1 + 0.00875)120 / (1 + 0.00875)120 – 1) = 13,493. To repay the total loan, you will have to pay $13,493 over 120 months. The total amount due will be 13,493 * 120 = 16,19,220, which includes $6,19,220 in loan interest.

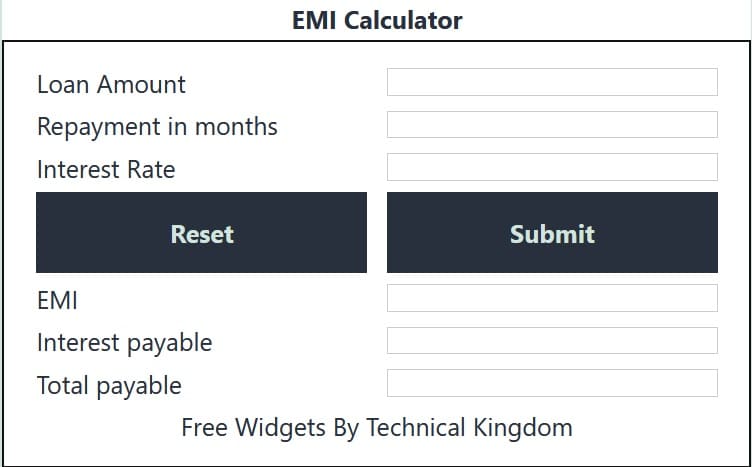

Using the above EMI calculation by hand or in MS Excel to calculate EMI for various combinations of principal loan amount, interest rate, and loan period is time consuming, difficult, and error prone. Our EMI calculator does the math for you and displays the results in real time, along with graphic charts that show the monthly schedule and total payment breakdown.

Our EMI Calculator is simple to operate, intuitive to comprehend, and quick to complete. This calculator can be used to determine the EMI for a home loan, a car loan, a personal loan, an education loan, or any other fully amortising loan.

In the EMI Calculator, enter the following information:

You want to take out a principal loan, so how much do you want to borrow? (rupees)

Term of the loan (months or years)

Interest Rates (percentage)

EMI in advance OR EMI after the fact (for car loan only)

Adjust the values in the EMI calculator form with the slider. You can type the values directly in the relevant areas provided above if you need to provide more accurate values.

Want to make part prepayments on your home loan to shorten the term and lower your total interest expense? Use our EMI Calculator for Home Loans with Prepayments. Use our loan calculator to figure out how much loan you can pay or to compare advertised and actual loan interest rates (along with loan APR) on a purchase.

© 2021 All rights reserved

Ask Your Query