Menu

Return on invested capital (ROIC) is a ratio that seeks to reflect a company’s profitability / value-creation potential compared to the amount of capital invested by measuring how well it can deploy its capital and create operating return per unit of invested capital. In absolute terms, the greater the ROIC percentage, the better the investment is for the firm’s stockholders, yet a relative comparison to another investment option may still be unfavorable for the company. When evaluating the relative efficiency of invested capital, ROIC is frequently compared to WACC .

A ROIC calculator’s output is normally expressed as a percentage, and only rarely as a ratio. The ROIC ratio or percentage is frequently employed alongside the P/E ratio in stock valuations: a firm with a high P/E ratio but a consistent solid return on capital may be valued at a higher premium than equities with lower P/Es but less consistent returns. In terms of which business segment (of a larger firm) is creating the value, the statistic is opaque.

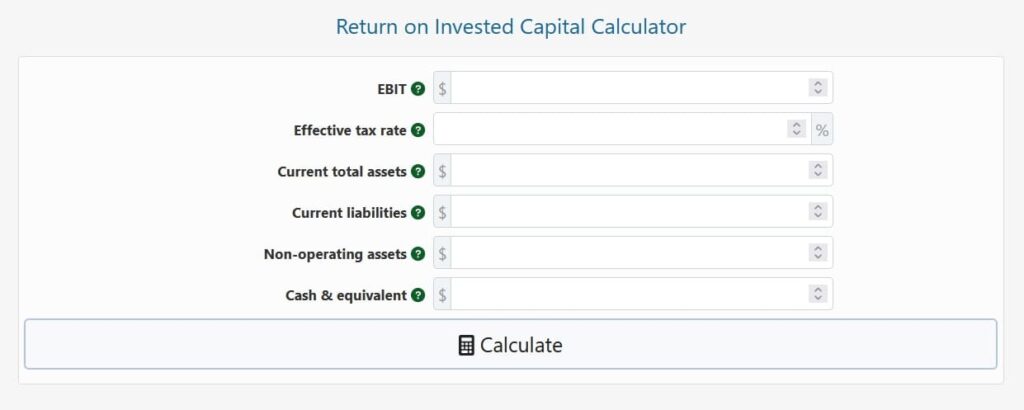

While our return on invested capital calculator is simple to use once you have the necessary input data, some numbers required to calculate the return on invested capital may be difficult to obtain from a balance sheet and income statement, as some values may only be found in addendums and auxiliary documents.

The formula for calculating ROIC is straightforward:

ROIC = (Net operating profit – Adjusted taxes) / Invested Capital x 100

The formula for calculating ROIC is straightforward: This is also the formula we utilise in our ROIC calculator.

The net operating profit is commonly referred to as EBIT (earnings before interest and taxes), whilst the adjusted taxes can be replaced by the effective tax rate, which is calculated by multiplying the EBIT by (1 – Tax Rate( % ) / 100). You’ll quickly see that the NOPAT is the numerator in the equation (Net Operating Profit After Tax, the net after-tax operating profit).

Current liabilities, cash and equivalent holdings, as well as non-operating assets (assets from ceased operations) are normally subtracted from the total current assets of the company to arrive at the invested capital. This yields a denominator for the ROIC calculation that should be for a single year, while some practitioners may prefer to calculate an average invested capital over two or more years instead.

As you can see, the formula uses book values rather than market values because market values reflect market expectations, which we don’t want to use in a ROIC calculation.

Consider the case of ACME X, a hypothetical firm that had a $54,000 operational profit last year and has an effective tax rate of 21%. The numerator, NOPAT, is calculated as follows:

NOPAT = 54,000 x (1 – 21/100) = (54,000 x 0.79) = $42,660 NOPAT = 54,000 x (1 – 21/100) =

The corporation has $10,000 in current liabilities, $5,000 in discontinued operations assets, and $2,000 in cash. It has a total of $260,000 in current assets. We deduct liabilities, non-operating assets, and cash from total current assets to arrive at the total invested capital (the numerator in the calculation above):

Invested Capital = $260,000 – ($10,000 + $5,000 + $2,000) = $260,000 – $17,000 = $243,000

Finally, we multiply the NOPAT/Invested Capital ratio by 100 to get the ROIC percentage:

ROIC (%) = $42,660 / $243,000 x 100 = 0.1755 x 100 = 17.55% and it appears the stakeholders will likely be happy with the profitability of ACME X. Our calculator can be used to double-check your calculations.

© 2021 All rights reserved

Ask Your Query