Menu

Compound interest is a type of interest in which the interest amount is added to the principal amount on a regular basis, and new interest is accrued over previous periods’ interest. While some financial institutions will show their products’ annual percentage yield (APY), also known as the effective interest rate, many will just list the annual percentage rate (APR), which is a simple multiplication and does not reflect your actual interest rate. In such instances, calculating the yearly percentage yield is the easiest way to figure out how much money your Certificate of Deposit will create for you.

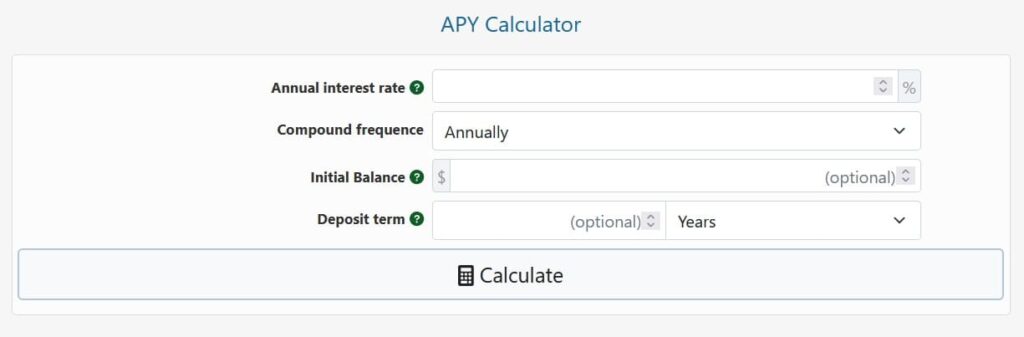

Our online APY calculator is a handy tool for calculating:

Begin by specifying the simple annual interest rate (ARP), then the compounding period – you may need to ask your bank for this information, but it is frequently published on offers and deposit descriptions. Finally, if you intend to make regular contributions to the deposit (monthly, yearly, etc. ), enter the amount and the period during which you will make it, as well as whether you will make it at the start or end of the period.

You can also enter your deposit’s starting balance and term, which will allow our tool to determine the overall capital growth and interest profits you can expect.

The Annual Percentage Yield (APY), the amount of your deposit or investment at the conclusion of the term, the interest accrued, and the percentage capital growth are all calculated using our interest calculator. It’s worth noting that none of these calculations account for any bank fees, taxes, or servicing fees that may apply.

The annual percentage yield formula is all you need to compute the APY on your own or with an Excel spreadsheet:

APY(%)=[(1+r/n)n – 1].100

where r is the decimal representation of the simple annual interest rate and n is the number of compounding periods each year. The computation is APY = ((1 + 0.02/4)4 – 1) for a Certificate of Deposit with an annual interest rate of 2% and quarterly compounding. * 100 = (1.020154) – 1) * 100 = (1.02015 – 1) * 100 = (1.02015 – 1) * 100 = 2.015 percent yearly percentage yield

The compounding frequency, or how often interest is added to the principal, can have a little beneficial impact on the effective interest rate compared to the nominal yearly interest rate. Using our compound interest calculator with shorter compounding periods can quickly show you how large that influence is. Daily compounding (also known as continuous compounding) produces the most effective rate, whereas monthly or yearly compounding produces somewhat lower results.

The compounding frequency, or how often interest is added to the principal, can have a little positive impact on the effective interest rate of a Certificate of Deposit (CD) compared to the nominal annual interest rate. By using the above CD calculator to enter shorter compounding periods, you can quickly see how big of an impact this could have on your overall savings. Daily compounding (also known as continuous compounding) gives you the most effective rate, whereas monthly or yearly compounding gives you a slightly inferior rate.

To make the comparison easier, no further deposits are assumed. As you can see, the APY is quite near to the annual interest rate for small sums and makes little difference, especially over short time periods. With longer time periods, this effect gets more pronounced, and it becomes significant for high deposit amounts.

© 2021 All rights reserved

Ask Your Query