Menu

A certificate of deposit is a contract in which the holder agrees to deposit money for a set length of time in exchange for interest. Deposit terms typically range from one month to five years, with longer terms being rare. The most common deposit terms are three months, six months, one year, and twenty-four months (two years). Compounding interest rates apply to most accounts, which means that the accumulated interest on the principal is added to the principal on a regular basis, resulting in a growing amount of interest without the need for further money deposits.

The rate of interest on a CD is its most important feature; the greater the rate, the better, all else being equal. Longer-term deposits often offer higher interest rates at the cost of capital lock-in and increased inflation risk. When actual paper certificates were provided to certify the deposit arrangement, the name ‘certificate of deposit’ was retained for historical purposes. In most cases, this is no longer the case. Deposits often pay higher interest rates than savings accounts, other bank accounts, or money market accounts, but this isn’t always the case, especially with so-called flexible deposits that have no or low early withdrawal costs. It’s worth noting that the penalties for early withdrawal in a normal CD are rather high, making a deposit a worse investment than a savings account if it comes to it.

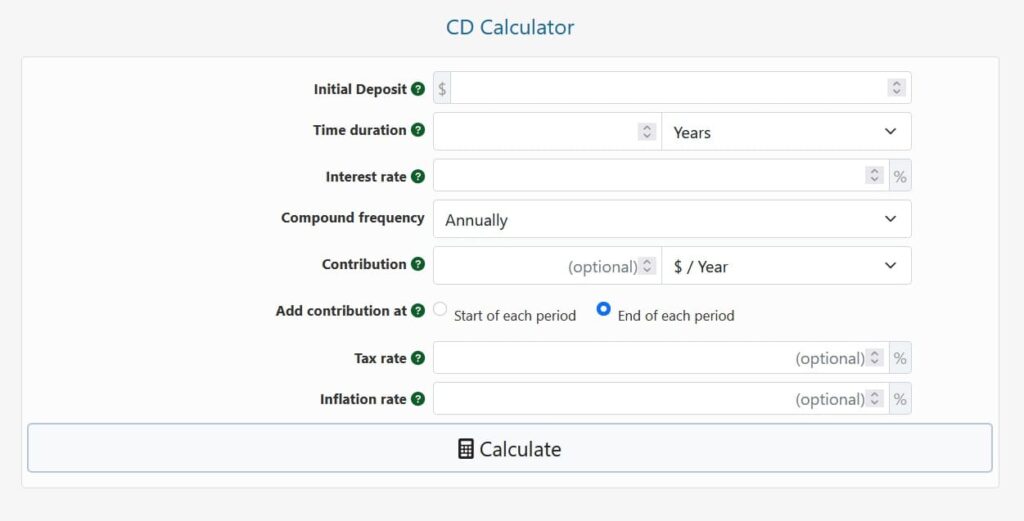

Our CD calculator is a handy financial tool that can help you figure out things like

Start by entering the amount of your initial deposit, or your current balance if you already have one. Then input the deposit term, which is normally expressed in years but can also be expressed in months, quarters, or other time periods.

Proceed to enter the annual interest rate, which is commonly expressed as an annual percentage rate (APR) on deposit offers and bank product comparison sites and does not account for compounding. This is not to be confused with the Annual Percentage Yield (APY), also known as the Effective Annual Interest Rate, which our calculator will compute for you. It’s worth noting that the APR and APY don’t take into account fees or other costs associated with managing the deposit. Enter the applicable marginal tax rate if the interest rate is taxable.

Specify the compounding term, which should be specified on both the offer and the CD agreement. If you intend to make regular contributions to the deposit (monthly, yearly, etc. ), enter the amount and the time period for which you will make it, as well as whether you will make it at the start or end of the period.

Finally, you can anticipate the average rate of inflation ( in percent ) you expect over the CD’s duration. Significant departures from this average will have an impact on the accuracy of any inflation-adjusted estimates, therefore use them only as a guideline.

The CD calculator will calculate the total CD return from interest (also known as ‘CD earnings,’ ‘CD yield,’ or simply ‘CD savings’), the effective interest rate (also known as the Annual Percentage Yield or simply ‘CD rate’), the capital growth as a percentage, the deposit value at the end of the term, and the sum total of taxes and contributions or withdrawals. You’ll see a few inflation-adjusted values if an inflation rate was entered.

Compounding frequency refers to how often interest is added to the principal, and it can have a little positive impact on the effective interest rate (also known as Yearly Percentage Yield (APY)) compared to the nominal annual interest rate (APR). When comparing yearly compounding to daily compounding (also known as continuous compounding), daily compounding (also known as continuous compounding) yields a slightly higher effective rate.

If you’re undecided, go with annual compound interest. However, it is preferable to inquire about this information with your banking institution.

The aim in this example is to calculate the accrued interest on a $10,000 certificate of deposit with a 2.5 % yearly interest rate over a two-year period. To make the computation easier, assume annual compounding interest and no contributions (monthly or yearly deposits). Assume there is no tax on interest for the same reason.

The math is simple throughout the first year. Starting with $10,000 at 2.5 percent interest, $10,000 x 0.025 = $250 in interest results in a total of $10,250 at the conclusion of year one. Compounding is included in the second year’s calculation. To compute the interest on what is now essentially a $10,250 deposit, start by adding the $250 returned in year one to the principal. At 2.5, that’s $10,250 x 0.025 = $256.25, thus the deposit will be worth $10,556.25 at the end of year two. The difference between the end amount and the initial value is the return: $556.25.

The predicted inflation rate, which is commonly given in percentages, is a significant consideration when making any financial investment choice. Simply said, if the rate of inflation is higher than the CD interest rate, inflation can diminish the return on a CD in real-money terms and even render it negative. Even when the deposit interest rate is larger than inflation, a negative return in constant dollars is possible, depending on taxes.

The table below explores several scenarios, all with the same 2% CD rate and 4% tax rate, but with different rates of inflation:

Return on a CD investment with inflation adjustment

Our calculator was used to complete the calculations. As the figures illustrate, even little increases in inflation can have a significant influence on inflation-adjusted returns and growth. Due to the interest rate tax, even when inflation is equal to the CD interest rate, the return is somewhat negative. That’s true, you’re paying taxes even though you’re losing money in the actual world.

© 2021 All rights reserved

Ask Your Query