Menu

Mortgage calculators are computer-assisted tools that allow users to calculate the financial consequences of changing one or more variables in a mortgage financing agreement. Consumers use mortgage calculators to calculate monthly payments, while mortgage lenders use them to assess a house loan applicant’s financial appropriateness. Although the Consumer Financial Protection Bureau has created its own public mortgage calculator, mortgage calculators are routinely found on for-profit websites.

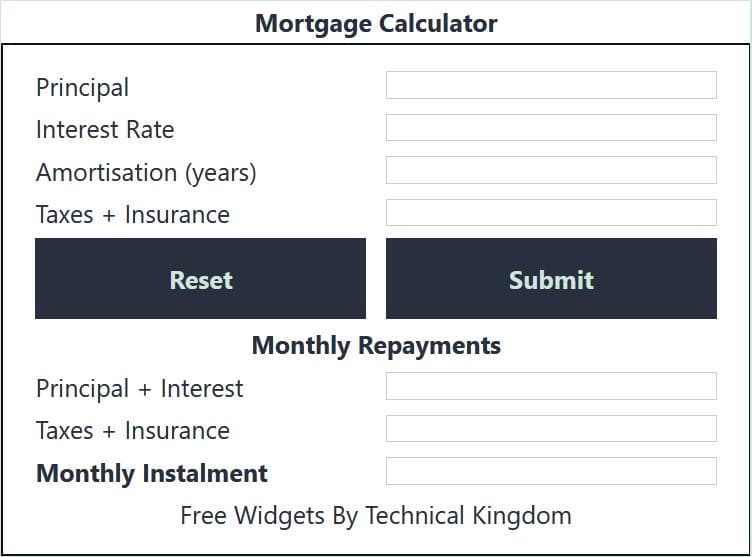

The loan principal, balance, periodic compound interest rate, number of payments per year, total number of payments, and monthly payment amount are the primary elements in a mortgage calculation. Other expenditures linked with a mortgage, such as local and state taxes, and insurance, can be factored into more complex calculations.

Most purchasers prefer to finance a portion of the purchase price with a mortgage when purchasing a new house. Those desiring to understand the financial ramifications of changes to the five primary factors in a mortgage transaction were required to use compound interest rate tables prior to the widespread availability of mortgage calculators. To utilise these tables properly, you’ll need a basic understanding of compound interest mathematics. Mortgage calculators, on the other hand, make solutions to inquiries about the impact of changes in mortgage factors available to anyone.

Mortgage calculators can help you with questions like:

What will the monthly payment be if one loans $250,000 at a 7% annual interest rate and repays the loan over thirty years, with $3,000 in annual property taxes, $1,500 in annual property insurance, and 0.5 % private mortgage insurance? $2,142.42 is the correct answer.

https://en.wikipedia.org/wiki/Mortgage_calculator

© 2021 All rights reserved

Ask Your Query