Menu

Our return on assets calculator uses the following ROA formula:

ROA = Net Income / Total Assets

The outcome is a ratio, with both input numbers in the relevant currency. Simply multiply the ratio by 100 to get a percentage result.

The return on assets (ROA) statistic is used to determine how effectively a firm or project uses its capital assets. It’s computed as the earnings of a corporation divided by the total value of its assets.

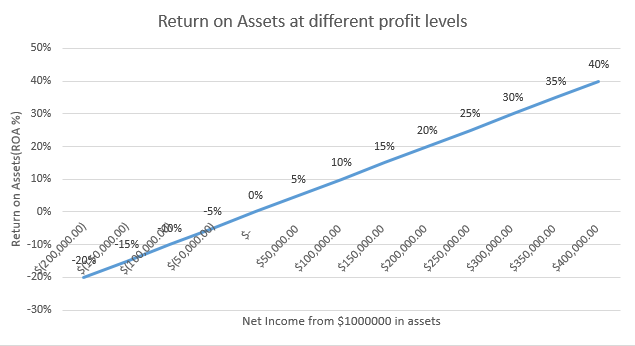

To arrive at the final result using the given formula, simply substitute the required values and use a calculator. For example, if a company’s net income (profit) for the fiscal year is $100,000 and it generated it with assets worth $500,000, its return on assets is 1/5 or 20%. In other words, for every $5 in capital assets, it yields $1 in value. Because total assets are the sum of total liabilities and shareholder equity, which change over the year, you can instead use their arithmetic average. A high ROA indicates that the company is growing its assets, whereas a negative ROA indicates that it is losing money.

If you are the sole shareholder in the business, the return on assets is the same as the return on investment (ROI), so you can use this return on assets calculator or a ROI calculator to the same end.

© 2021 All rights reserved

Ask Your Query