Menu

VAT stands for “Value-Added Tax” which is a sales tax on the value added to a starting good or service, or a natural state, and is calculated as a percentage of the final price of goods and services paid by an end customer. This is accomplished through a convoluted system in which each individual or firm who adds value to a product is repaid for the tax until the final customer pays it (which can also be a judicial person). In many nations, VAT is one of the most important sources of revenue for the government. Persons who believe in equality of result believe it is unjust to people in worse economic situations because it is a consumption tax that is borne proportionally by everyone who consumes.

The consistency of the tax’s implementation in different countries where it is used is where it gets complicated. VAT is most common in Europe (and consequently the EU), although it is also used in other countries, albeit with a different name in some cases.

For example, in some countries, the value-added tax (VAT) is levied uniformly at the same rate across the board, with rates typically ranging from 15% to 25%. Certain industries or categories of items or services, such as educational services and institutions, books and schoolbooks, basic foods and/or drinks, transportation, and so on, may be exempt from VAT. In other circumstances, it is an industry that is deemed critical for the overall operation of the economy on some, typically arbitrary criteria, such as tourism in countries where it provides a considerable percentage of GDP. In many countries, different VAT rates apply to different types of goods and services. For example, the official VAT rate may be 20%, but the rate of VAT on books may be 5%, while the rate of VAT on travel and accommodation services may be 10%. This is why having a VAT calculator on hand is quite beneficial.

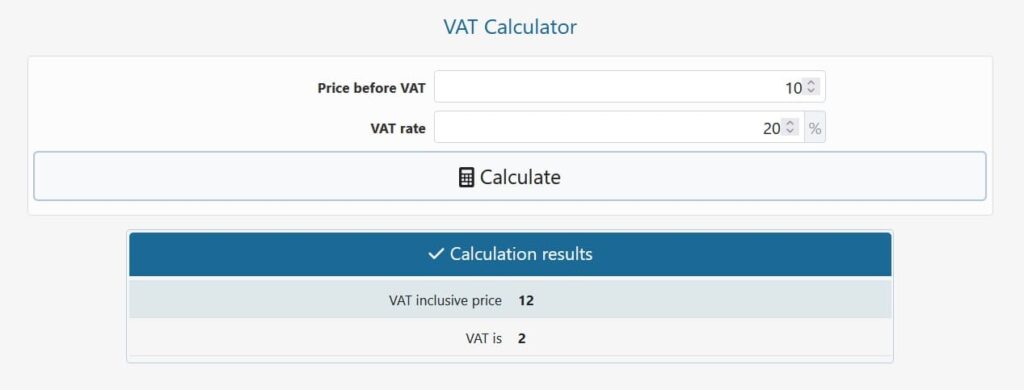

This VAT calculator’s formula for calculating VAT-inclusive prices is simple: it’s just a percent increase over the base price (gross amount, the amount excluding VAT). The formula is simple:

Price with VAT = Base Price x (100% + VAT(%))

For example, to add a 15% tax to a gross price of 100 euros, multiply €100 x (100% + 15%) = €100 x 115 percent = €115 net sum including VAT. Multiplying 100 euros by 1.15 is the mathematical equivalent.

In any currency, the formula for calculating how much sales tax to add to a gross sum is:

VAT = Base Price x VAT(%)

For example, if the gross amount is €20 and the tax rate is 10%, the VAT is €20 x 10% = €2. This is equivalent to multiplying 20 by 0.1, which is another method of calculating VAT. Obviously, the net amount is the gross amount plus the sales tax, so €20 + €2 = €22.

To eliminate VAT from a net price, simply divide by 1 + the vat rate, according to a simple adaptation of this formula. For example, if the tax rate is 20% (.2), simply divide by 1.2 to remove VAT and obtain the total amount.

Example 1: What is the net amount if you know the price without VAT is €80 and the VAT rate is 20%? It is not necessary to compute VAT individually in order to obtain the net amount. Simply replace the values in the first equation to get €80 x (100 % + 20% ) = €80 x 120 % = €80 x 1.2 = €96 with sales tax included.

Example 2: What is the absolute value of the value-added tax if you know the VAT rate for the product you’re buying is 20% and the gross amount is $50? The VAT amount is calculated using the second calculation above: $50 x 20% = $10 in sales tax.

Example 3: What is the amount that the merchant or service provider actually pockets if the net price for a good or service is €150 and the VAT rate is 20%? By replacing the base price with the final one and dividing instead of multiplying, the first calculation can be reversed. As a result, the price without VAT is estimated as €150 / (100% + 20%) = €150 / 120% = €150 / 1.20 = €125

© 2021 All rights reserved

Ask Your Query