Menu

This adaptable profit margin calculator will help you compute

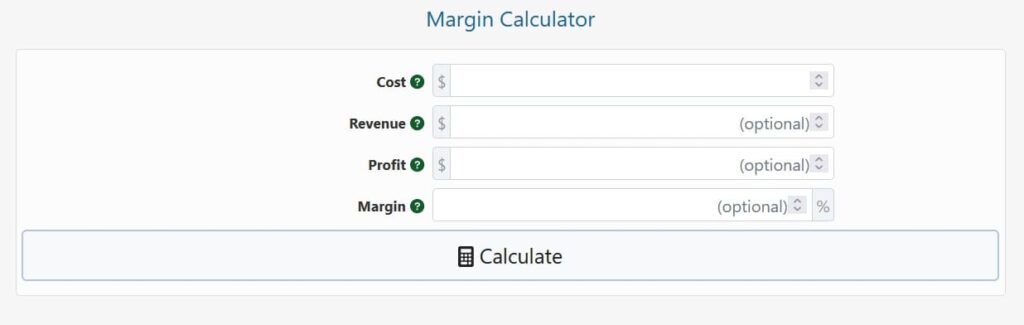

Simply enter the cost as well as any other business metrics that are relevant to the desired output and hit “Calculate”. The clipboard icon next to each value makes it simple to copy and paste the results. Knowing your margin and the markup required to produce a specific net or gross profit can aid in the successful operation of a firm.

The gross profit margin (also known as operating profit margin, operating income margin, or EBIT margin) is an important business performance statistic that indicates a company’s, product’s, or investment project’s profitability. It’s useful for comparing one period to the next, analysing profitability trends, and comparing to firms in similar industries, niches, sizes, and ages.

Because it represents the percentage of total revenue turned to operating profits, the profit margin is extremely important (before tax profits). As a proxy for possible dividend distributions, reinvestment possibilities, and overall solvency, it is frequently utilised by investors as an efficiency ratio or percentage statistic.The result is a measurement of what proportion of a company’s revenue is left over, before taxes and other indirect costs (such as bonuses, rate of interest payments), after paying for variable production costs like wages, source , contractors, etc. a better operating margin means the corporate has less financial risk because it is in a position to face fixed charge expenses with greater ease .

Whereas a gross profit margin margin is that the margin before taxes and interest, it does account for depreciation and amortization within the cost as a part of the equation. A net income margin would come with deductions of taxes and interest payments. so as to calculate it, include taxes and interest within the value for the “Cost” input field in our margin of profit calculator.

So, for net margin the value variable includes both COGS (Cost of products sold), expenses (Operating expenses and various expenses) and interest and taxes, whereas for margin of profit the value is simply COGS and expenses.

The formula for margin of profit is:

Margin = Operating income / Revenue

Operating income is additionally called “operating profit” whereas revenue is the total value of sales and it’s usually tightly tied to the asking price . In many cases the entire costs and revenue are known and what’s sought is the operating income and margin. In such circumstances the subsequent margin of profit formula is more suitable, which is why it’s utilized in our gross margin of profit calculator:

Margin = (Revenue – Cost) / Revenue

Both input values are within the relevant currency while the resulting margin of profit may be a percentage (gross margin percentage, e.g. 10%) received after multiplying the result by 100. Note that our margin of profit calculator doesn’t do any currency conversions, so confirm you input the values within the same currency.

Net margin formula

To compute the internet margin of profit , simply use the margin of profit equation above, but include taxes and interest payments within the cost variable. Margin of profit Cost means just the value of products sold and operating expenses whereas for net margin it’s the cost of products sold and expenses plus taxes plus interest payments on debt capital.

Knowing the formula above, you ought to start with estimating the value of production, which incorporates all variable costs of manufacturing the products or services the business sells. If calculating for a past period, you’d already know the gross sales that were made by selling the products or services. Simply connect the numbers in formula #2 above and you’ll get the result. For instance , if the prices are $100,000 and therefore the revenue is $120,000 the equation becomes: Margin = (120,000 – 100,000) / 120,000 = 20,000 / 120,000 = 1/6 which is the margin ratio telling you that for each 6 dollars in sales the business pockets 1 dollar in profit. To convert to percentage, multiply by 100: 1/6 * 100 = 16.67% operating margin of profit .

If you recognize only the value and therefore the profit, simply add the 2 together to urge the revenue, then substitute in equation #2 again.

If what you would like to calculate is the profit and/or revenue required to realize a given margin, then simply input the value and therefore the margin percentage in our calculator and it’ll handle the remainder .

© 2021 All rights reserved

Ask Your Query