EXCEL ACCRINTM FUNCTION

Excel ACCRINTM Function Introduction

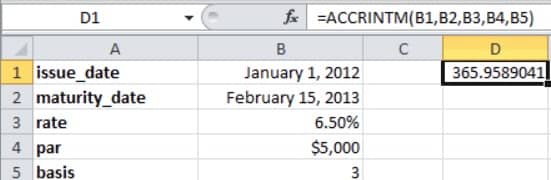

The Excel ACCRINTM function calculates the accumulated interest on a securities that pays interest at maturity.

Description of Excel ACCRINTM Function

Syntax :

=ACCRINTM( issue_date, maturity_date, rate, par, [basis] )

Parameters :

- issue_date : The date on which the security was issued is referred to as the issue date.

- maturity_date : The security’s maturity date

- rate : The rate is the security’s yearly coupon rate.

- par : A security’s par value. If this argument is not specified, the ACCRINTM function will presume that the par value is $1,000.

- basis : Optional basis It is the day count to be used for computing interest on the security. If this option is left blank, the basis is assumed to be set to 0. It can be any of the following:

| Value | Explanation |

|---|---|

| 0 | US (NASD) 30/360 |

| 1 | Actual/Actual |

| 2 | Actual/360 |

| 3 | Actual/365 |

| 4 | European 30/360 |